Full paper: Lu, S. (2024), “Is Sub-Saharan Africa ready to serve as an alternative apparel-sourcing destination to Asia for US Fashion companies? A product-level analysis“, Competitiveness Review, Vol. ahead-of-print No. ahead-of-print. https://doi.org/10.1108/CR-03-2024-0041

Summary:

The prospect of Sub-Saharan Africa (SSA) as an apparel-sourcing base for U.S. fashion companies has been a growing heated debate. On the one hand, U.S. fashion companies, driven by increasing geopolitical concerns and other market factors, were eager to diversify apparel sourcing away from Asia. The SSA region was often regarded as one of the most popular alternative sourcing destinations thanks to its large population, relatively low labor costs, and shorter shipping distance to U.S. ports compared to most Asian. The African Growth and Opportunity Act (AGOA), a trade preference program enacted in 2000, in particular, allowed eligible apparel exports from SSA countries to enter the United States import duty-free, creating substantial financial incentives for U.S. fashion companies to source from the SSA region.

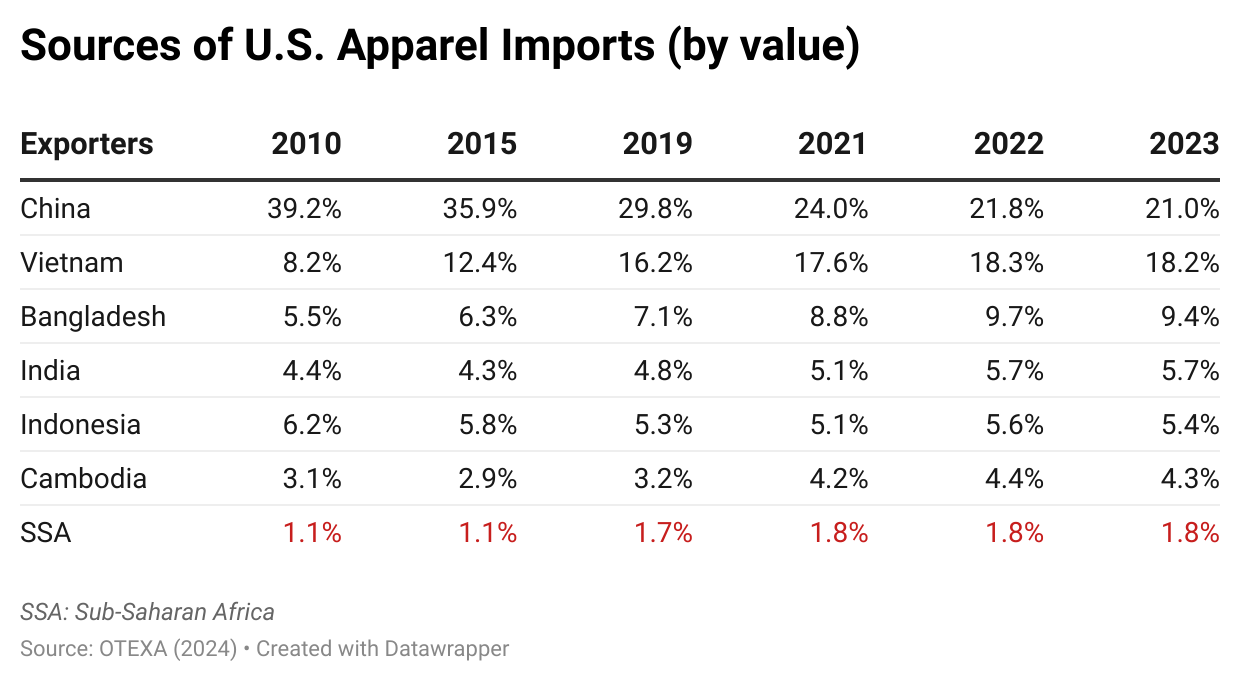

However, empirical trade data shows that U.S. apparel imports from SSA members have stagnated over the past decades without evident growth. Notably, with little change from 2010, SSA countries collectively accounted for only 1.8% of U.S. apparel imports in 2023, with no single SSA member achieving a market share of more than 1%. In contrast, over the same period, despite China’s declining market shares, the following five largest Asian suppliers—Vietnam, Bangladesh, India, Indonesia, and Cambodia—jointly accounted for 43.0% of U.S. apparel imports in 2023, a notable increase from 27.4% in 2010.

This study aims to evaluate SSA countries’ capacity to serve as an alternative apparel sourcing destination to Asian suppliers for US fashion companies. Specifically, the study examined the detailed product information of a total of 10,000 stock keeping units (SKUs) of clothing items sold in the U.S. retail market from January 2021 to December 2023. Half of these items were sourced from the six largest apparel-exporting countries in SSA: Lesotho, Kenya, Mauritius, Ethiopia, Madagascar, and Tanzania. Together, these countries accounted for over 96% of the value of U.S. apparel imports from the SSA region between 2021 and 2023. The remaining half came from China, Vietnam, Bangladesh, Cambodia, India, and Indonesia, the six largest Asian apparel exporters, which stably accounted for approximately 90% of U.S. apparel imports from Asia over the past decade.

Key findings:

First, the results revealed that U.S. fashion companies’ sourcing strategies for SSA countries appeared more subtle and complicated than simply treating the region as another low-cost sourcing destination, as suggested by previous studies. Instead, according to the results, U.S. fashion companies seemed to leverage SSA countries as suppliers of “niche products,” such as those relatively simple and basic apparel categories containing African cultural elements and targeting the luxury and premium market segment. Meanwhile, the demand for such products could be much smaller than regular apparel items sold in the value and mass market. This allows SSA countries to fulfill these smaller orders despite their limited production capacity, often family-owned or involving handmade processes.

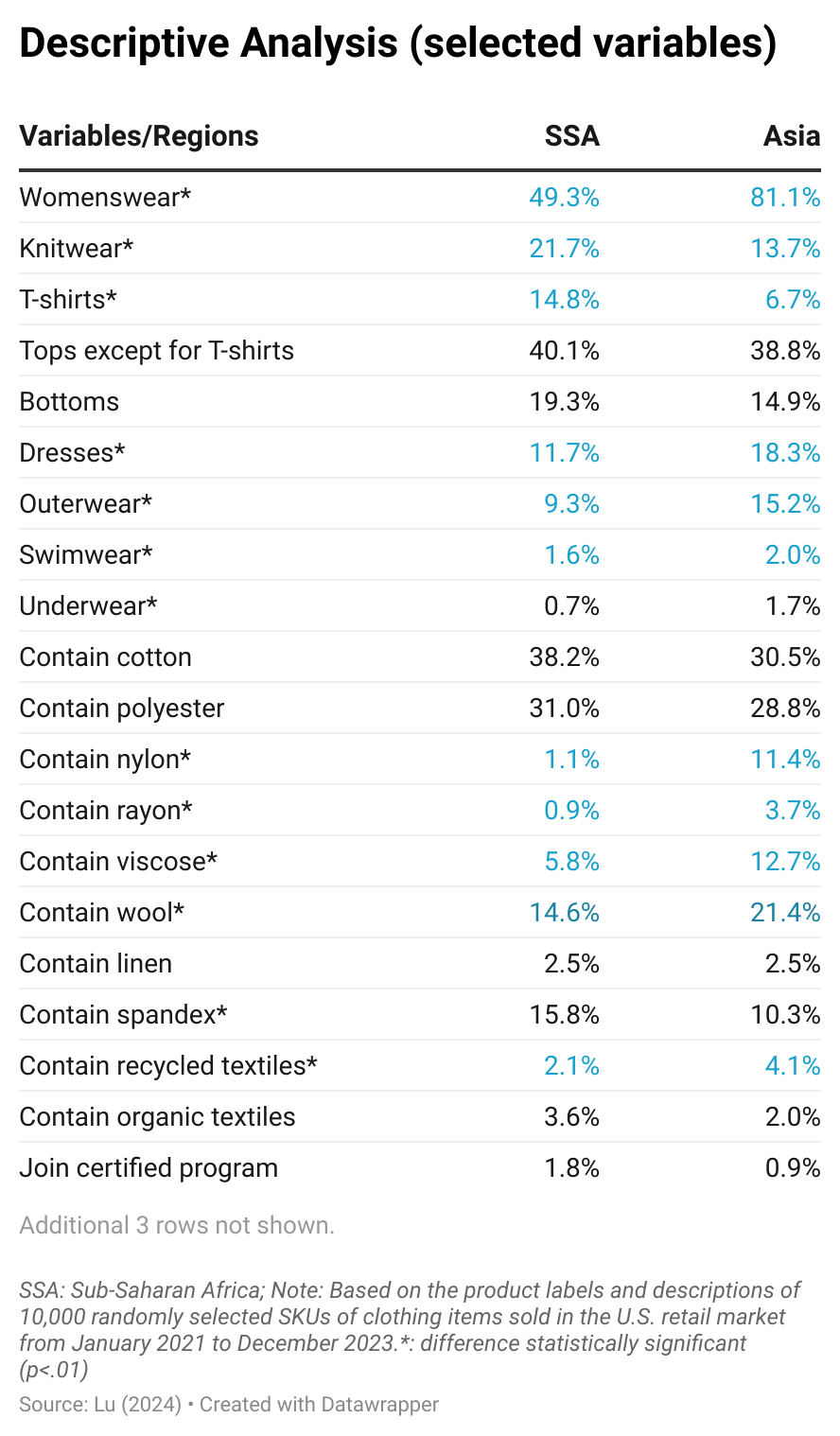

Second, the study’s findings identified significant challenges for SSA countries serving as immediate alternatives to sourcing from Asia for U.S. fashion companies. While SSA countries could offer relatively low sourcing costs, the range of apparel products available for U.S. fashion companies to source from the SSA region remained significantly more limited than those from Asia. For example, results show that U.S. fashion companies preferred sourcing relatively basic and technologically simple categories like knitwear, T-shirts, and bottoms from SSA countries. However, imports from SSA countries offered more limited sizing and color choices and were less likely to include womenswear and relatively more sophisticated or specialized product categories such as outerwear and swimwear. As another example, U.S. apparel imports from SSA countries were primarily made of cotton and polyester, with less use of other fiber types, including nylon, rayon, viscose, wool, and those made from recycled textile materials (see table below).

Third, building on the previous point, the results call for new thinking on strengthening SSA countries’ genuine competitiveness as an apparel-sourcing destination. Over the past decades, trade preference programs such as AGOA have mainly focused on improving the price competitiveness of SSA countries’ apparel exports. However, as this study’s findings illustrate, AGOA and other trade preference programs seemed inadequate in assisting SSA countries in developing capacity beyond basic apparel categories and securing a sufficient variety of textile materials. As U.S. fashion companies have placed greater emphasis on factors beyond price in their sourcing decisions, such as flexibility, agility, sustainability, and vendors’ capability to make a wide variety of products, this could put SSA countries at even more significant disadvantages down the road to being considered alternatives to Asia for apparel sourcing.

The results also reminded us that AGOA’s liberal rules of origin, which allowed least-developed SSA countries to use textile materials from anywhere worldwide, cannot replace the crucial need to develop the local textile manufacturing capacity within the SSA region. Without a robust local textile manufacturing sector, SSA countries would encounter significant challenges in diversifying their product offerings to include more complex and versatile clothing categories, such as outerwear and women’s dresses. These categories typically require a wide variety of raw textile materials and accessories, making it highly impractical and inefficient to rely solely on imports for their supply.

On the other hand, the findings reveal the necessity of creating a stable and foreseeable business environment, such as the long-term renewal of AGOA, to attract more long-term investments in SSA. For example, investing in and strengthening SSA countries’ local supply of sustainable textile materials, such as recycled or organic fibers, could strategically enhance SSA countries’ competitiveness in meeting the increasing demand from U.S. fashion companies for sustainable apparel products.

Additional reading:

- Sourcing Journal: Report: As African Apparel Imports Dwindle, the Time for AGOA Renewal is Now

- Melissa Nelson (General Counsel of SanMar Corporation)’s Senate Finance Committee Testimony about apparel sourcing from AGOA (June 5, 2024)